The 2-Minute Rule for Guided Wealth Management

Fascination About Guided Wealth Management

Table of ContentsThe Single Strategy To Use For Guided Wealth ManagementAn Unbiased View of Guided Wealth ManagementHow Guided Wealth Management can Save You Time, Stress, and Money.The 15-Second Trick For Guided Wealth ManagementGuided Wealth Management Can Be Fun For Everyone

Look out for possible problems of interest. The consultant will certainly establish up a property allowance that fits both your danger resistance and risk capacity. Possession appropriation is simply a rubric to identify what percentage of your total monetary profile will be dispersed across various property classes. A more risk-averse individual will certainly have a better focus of federal government bonds, certificates of down payment (CDs), and cash market holdings, while an individual who is more comfortable with risk may make a decision to take on more stocks, business bonds, and probably also financial investment genuine estate.

The ordinary base pay of a monetary expert, according to Without a doubt since June 2024. Note this does not include an approximated $17,800 of yearly commission. Anybody can deal with an economic expert at any age and at any phase of life. financial advisor north brisbane. You don't need to have a high total assets; you simply need to locate an expert fit to your scenario.

The smart Trick of Guided Wealth Management That Nobody is Discussing

Financial experts work for the client, not the business that uses them. They must be receptive, ready to discuss economic ideas, and keep the customer's finest rate of interest at heart.

An advisor can recommend possible renovations to your plan that may help you attain your goals much more efficiently. Ultimately, if you do not have the moment or rate of interest to handle your financial resources, that's another great reason to work with a monetary advisor. Those are some general factors you could need an expert's expert assistance.

Search for an expert who concentrates on educating. A great economic consultant should not just market their services, however give you with the tools and sources to become economically savvy and independent, so you can make educated choices by yourself. Choose a consultant who is enlightened and well-informed. You want a consultant who remains on top of the economic range and updates in any location and that can address your economic questions concerning a myriad of topics.

Facts About Guided Wealth Management Uncovered

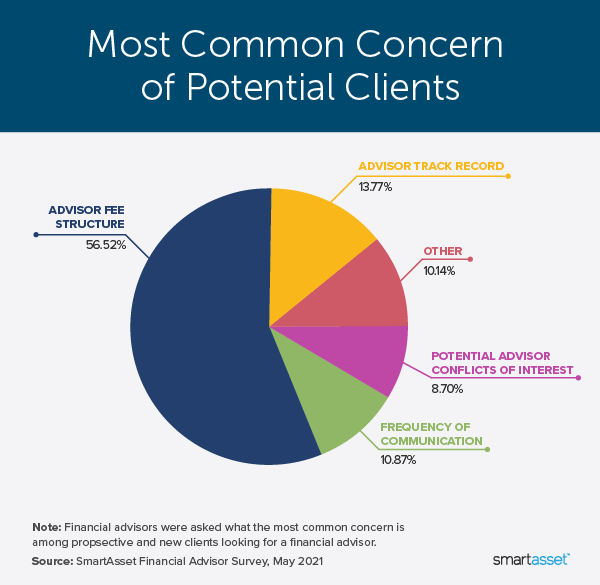

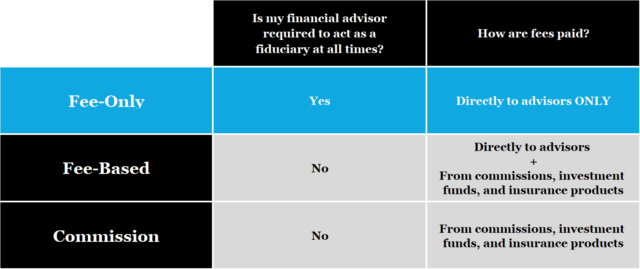

Others, such as qualified monetary organizers(CFPs), already complied with this criterion. Even under try this site the DOL rule, the fiduciary standard would certainly not have related to non-retirement suggestions. Under the suitability requirement, financial experts typically service compensation for the items they sell to customers. This suggests the customer might never get a bill from the financial consultant.

Costs will likewise differ by place and the advisor's experience. Some experts may provide reduced rates to help customers that are just obtaining begun with economic planning and can not pay for a high monthly price. Normally, an economic advisor will use a complimentary, first consultation. This examination gives a possibility for both the client and the expert to see if they're a good suitable for each various other - https://www.edocr.com/v/vz52jzxa/bradcumner4020/guided-wealth-management.

A fee-based consultant may gain a cost for developing a monetary plan for you, while additionally earning a payment for marketing you a certain insurance coverage product or investment. A fee-only financial advisor earns no commissions.

The Main Principles Of Guided Wealth Management

Robo-advisors don't require you to have much cash to get begun, and they cost much less than human economic advisors. A robo-advisor can't talk with you regarding the finest means to get out of financial debt or fund your youngster's education and learning.

An advisor can aid you find out your financial savings, how to develop for retired life, assist with estate planning, and others. If nevertheless you just require to talk about portfolio allocations, they can do that too (generally for a charge). Financial consultants can be paid in a variety of means. Some will be commission-based and will certainly make a percentage of the items they steer you right into.

The Main Principles Of Guided Wealth Management

:max_bytes(150000):strip_icc()/ria.asp-final-88c8a25158a4433189b6796713a7ae3c.png)

Marital relationship, separation, remarriage or simply relocating in with a brand-new partner are all turning points that can call for careful planning. Along with the commonly challenging emotional ups and downs of divorce, both partners will certainly have to deal with essential economic considerations. Will you have sufficient income to sustain your way of life? Exactly how will your investments and various other possessions be divided? You might quite possibly need to alter your economic method to keep your goals on course, Lawrence states.

A sudden increase of cash or properties raises prompt inquiries about what to do with it. "An economic expert can help you believe with the means you could put that money to work towards your individual and monetary objectives," Lawrence claims. You'll wish to consider just how much might most likely to paying for existing debt and just how much you may take into consideration spending to seek a more safe and secure future.